Market Commentary

Commercial Real Estate Outlook: Third Quarter 2011

November 14, 2011 | Posted by: Francine Tracey

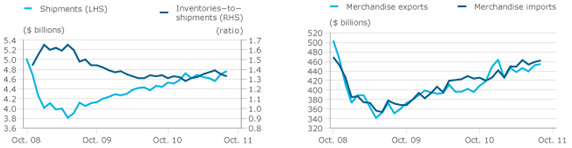

Despite the gloomy global outlook and a recent downgrade of Canadian growth projections by the Bank of Canada, Canadian firms remain cautious but hopeful, as evidenced by the result of the Bank’s autumn Business Outlook Survey. While businesses still intend to increase employment and investment in machinery, their

The outlook for

Multifamily Development and Investment:

In British Columbia, multi-family development activity will continue to be focused around major transit routes (source Translink), as the GVRD continues to increase densities in these areas. First time buyers are more likely to head towards these new communities which are designed to incorporate both transit and retail and community amenities to enhance the pedestrian and neighbourhood experience and decrease the dependency on single user vehicle transport.

The City of Vancouver badly needs affordable housing, however, current city policies are preventing multi-family rental investment and a recent moratorium doesn’t help matters.

“Vancouver densities need to be increased (source Goodman Report www.goodmanreport.comand Business in Vancouver):

Replacing Vancouver’s ageing rental stock to maintain affordable housing options is going to be financially painful and politically distasteful unless neighbourhoods accept higher building densities, there will be no new development and homeowner taxes will continue to climb.

Conventional wisdom held that investors would fill the gap in rental stock created by the demolition of rental apartments. But the (recent) loss of rental units was considered serious enough that the city imposed a demolition moratorium on apartment units in RM-3 zones like South Granville, home to most of the city’s walk-up apartments. Any rental units demolished had to be replaced one-for-one in new developments.

Building rental units have been harder to achieve because it requires higher neighbourhood density. Vancouver now boasts the highest multi-family rents in Canada, with CMHC pegging one-bedroom rents at $934 a month and two-bedroom units at $1,181 a month. However, without condos, or some other means of being repaid for its investment, a developer can’t afford to build rental units because rents, while among the highest in Canada, are out of line with Vancouver land costs. The average age of the city’s rental stock is about 58 years old, but rents don’t reflect current land economics.”

Industrial Real Estate Market

This market may be positively affected by the

- Metro Vancouver Market Overview (source Colliers International Market Report)

Net absorption in the third quarter totalled to 200,882 square feet, down from 295,410 square feet last quarter. The vacancy rate held steady at 4.1%, and the volume of sale transactions continued to decline due to lack of supply, while demand from investors continued to grow. While tenants remain cautious of the economy, activity across all markets is increasing, creating a positive outlook moving into the fourth quarter of 2011.

- Tri-Cities/Burnaby/North Vancouver/Vancouver (source Colliers)

Leasing activity was slow in Burnaby and the Tri-Cities, and vacancy rates increased in all markets. Port Coquitlam experienced the largest jump in vacancy to 3.5

In the latter part of the third quarter, activity increased and tenants were actively touring. Existing tenants were content with remaining in their current market as shown by two significant renewals: Rona Revy Inc. renewed 50,356 square feet from Standard Life Assurance Company at 1160 East 3rd Street in North Vancouver and Rolls Royce Canada Ltd. renewed 44,544 square feet at 96 North Bend Street in Coquitlam.

The region continues to be an attractive area for investors; however, the general constraint on the supply of quality product in Metro Vancouver has resonated in the region. The most significant investment transaction of the third quarter was Lloyd Investments Ltd. ‘s acquisition of 116,500 square feet at 1765 Coast Meridian Road in Coquitlam for $8.9 million.

Should the strong activity in Burnaby, Vancouver and North Vancouver continue, it is expected that vacancy rates will continue to compress and rental rates will remain firm throughout the end of the

Office Leasing and Real Estate: (source CBRE Global Knowledge Center)

Despite ongoing global economic challenges, leasing activity in the Metro Vancouver office market remained steady during the third quarter of 2011. The overall sentiment resonating throughout the market is that tenants remain cautious but active. Limited supply downtown has created a stable level of demand, and conversely, suburban office markets continue to work through existing vacancies providing competitive options for tenants. The confluence of these two factors has led to relatively positive indicators for the Metro Vancouver Office Market this quarter.

Regional vacancy rate remains unchanged at 8.7%. The downtown market recorded the largest gain among the submarkets. North Van and Richmond posting positive absorption offset Burnaby and New West with slightly negative absorption. Suburban market vacancy rate stands around 13.5%.

The market dynamics in Metro Vancouver are expected to change little over the next several quarters given the uncertain outlook for the economy and labour market. Overall modest and incremental gains in the market are expected, although most of the activity will be concentrated in the downtown and peripheral areas. The upcoming occupancy of a number of tenant’s downtown and in Burnaby should cause vacancy to decrease further next quarter, which will put more pressure on the demand cycle until significant new supply is added to the market. (Source CBRE.com)

Retail Real Estate Market Report (Source Cushman Wakefield and businesswire.com)

The Canadian retail real estate market continues to have an upwards trend in 2011, according to Cushman & Wakefield’s Main Streets across the World 2011 Research Report… “The strong Canadian Dollar has created an attractive market for US retailers looking to do business in Canada, because of increased profit margins. That is the largest force behind Canadian retail rental rates not only remaining stable but increasing in markets such as Edmonton, Vancouver and Montreal.”

In Toronto, Bloor Street has remained stable and is ranked as the 20th most expensive street in the world for retail space. This is largely due to continued consumer spending in Canada, along with heightened interest in Canadian presence from retailers in the United States, particularly in larger urban markets. Demand for space on the key high streets may improve further, with several retailers planning to open new stores.

While most Canadian retail markets remained stable, some other main streets in Canada have experienced great increases in rates and activity

Vancouver’s Robson Street also experienced a massive increase in rates, jumping from an average $220/square foot annually to $240, an increase of 9.1%.

Over the next two to three years, four factors will influence Metro Vancouver’s retail market: elimination of HST, urban densification, a new “tenant mix”, and millions of square feet of new retail supply. (Source Colliers International)

International retailers continue to flock to Canada in a calculated attempt to capture a share of a market-place that has proven, in some instances, close to double the sales volume per square foot compared to their native countries of operation.

Over the past year, a number of new developments have been announced and will be ready for occupancy in the next one to three years. During this time, more than 5.0 million square feet of new retail space will be added across the Lower Mainland in efforts to deliver space to new tenants and to service the exponential residential growth that has occurred over the last several years.

High Street, Fremont Village, Central at Garden City, and Tsawwassen Power Centre are the four most notable developments that will be ready for occupancy in the next two to three years. These four developments will add approximately 2.4 million square feet of retail space in Abbotsford, Port Coquitlam, Richmond and South Delta respectively.

Land Development:

Developers continue to seek quality investment opportunities particularly in regions characterized by rezoning for multi-family density. The mixed use commercial/residential zoned land is also in demand for redevelopment. Properties located close to transit, particularly sky train, with diverse neighbourhood amenities characterize great opportunities for redevelopment.